If the stock market moves sideways in 2024 with elevated volatility, this defensive equity strategy could come to your portfolio’s rescue.

Apart from a handful of mega cap technology stocks, 2023 has been a volatile, sideways year for the equity market. Through November, seven companies account for 14.9% of the market cap-weighted S&P 500’s 20.8% year-to-date return. Meanwhile, the S&P 500 Equal Weight Index is up just 6.6%. Many sectors of the market are negative for the year, including traditionally defensive sectors like Consumer Staples -2.1%, Health Care -2.2%, and Utilities -8.8%. Valuations also appear stretched, with the average price-to-earnings ratio of the S&P 500 at 19.3, well above its historical average of 17.0. Earnings expectations for 2024 have come down in recent months, and the economy is showing signs of slowing, with leading economic indicators having declined 19 months in a row.

With this gloomy outlook, many investors expect another choppy year from equities in 2024, which could benefit the popular options-based strategy of covered calls.

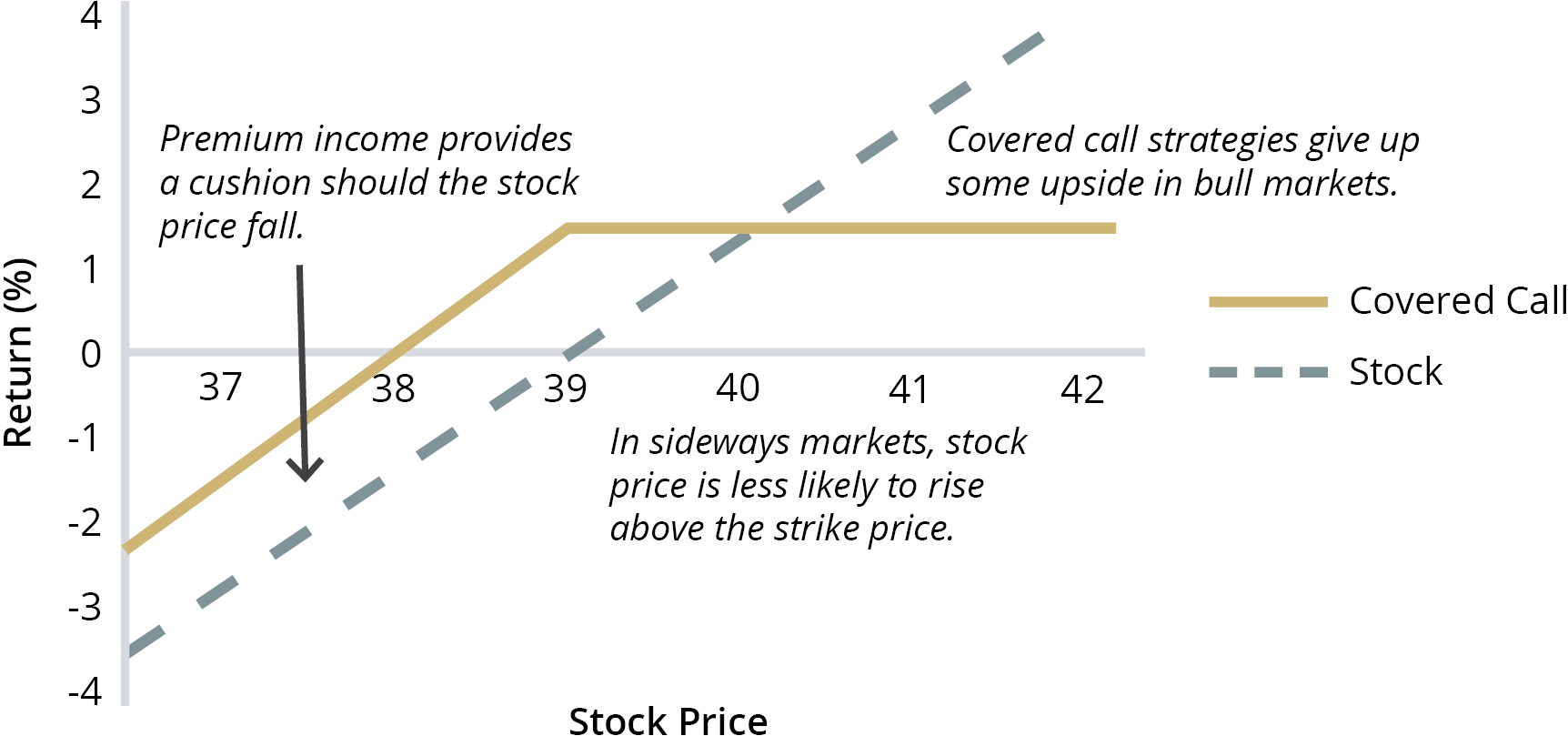

A covered call strategy involves owning an asset (such as shares of stock or index ETF) and simultaneously selling (writing) call options on the same asset. The strategy generates income for the investor through the premiums received from selling the call options in exchange for some or all of the upside potential of the underlying asset.

Covered call strategies are defensive by nature. While the strategy is not immune to the risks related to the underlying asset, the income from call-writing offers a cushion during down markets. They tend to lag during strong market rallies as underlying stocks are called away but can still participate depending on the option-writing strategy used. Where covered call strategies have historically proven valuable is in choppy sideways markets. The following are three reasons why 2024 could be the ideal environment for covered call strategies.

Higher premiums

As volatility in the stock market increases, the price of stock options usually increases, giving the portfolio the potential for even more income. Implied volatility, a key component in the pricing of options, represents the market’s expectations for future price fluctuations of an underlying asset. Greater implied volatility reflects the higher likelihood of wider price swings of the asset, which increases the risk premium of the option.

Options may expire without being called away

Unlike in a straight up market, in a flat market, call options are less likely to be exercised, meaning the writer of the call option keeps the premium and is not forced to sell the underlying stock position.

Alternative source of income

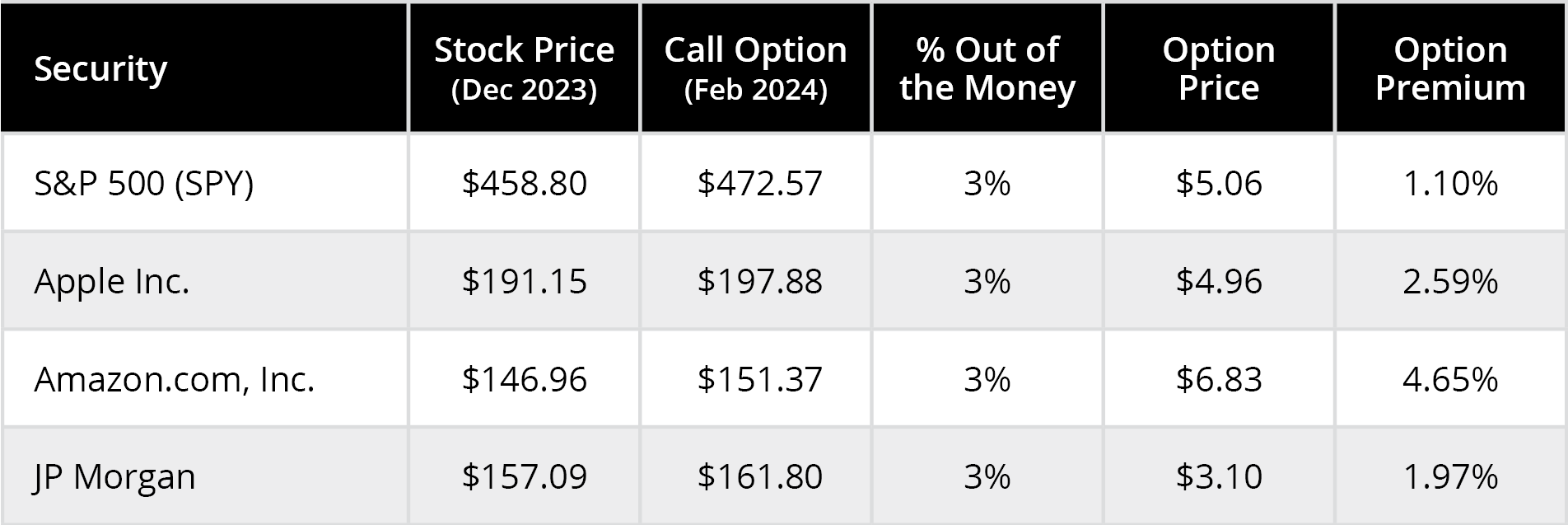

If interest rates were to fall rapidly in response to a slowing economy, the 5% yield on cash would likely dissipate, leaving income-needy investors in search of an alternative. For those willing to take on equity and options risks, covered calls can be an effective alternative. As of November 30, the price of a 77-day S&P 500 call option at 3% out of the money was $5.06, a 1.10% premium. Option premiums with similar terms for individual stocks can be even greater for the largest stocks in the Technology, Financials, and Consumer Discretionary sectors.

Sample Data Only. Call options have 77 days to expiration in this example. Securities identified for illustrative purposes only represent the largest companies by market cap in three distinct sectors; not intended to be a recommendation to buy or sell any security. At any given time there may be greater opportunities for option writing on individual securities than on indices, however not every individual security produces potential option premiums in excess of index options. Sample data does not include transaction costs, which would lower returns.

Madison Investments’ approach to covered call investing

Madison Investments has been a pioneer in covered call management since 2004. Our active approach starts with a concentrated portfolio of 30-50 high-quality stocks. We then utilize an active, single-stock options overlay to further manage risk by aligning each call option with our outlook for each stock. This defensive, “best-ideas” approach offers the potential for market-like returns with income and a degree of risk mitigation.

Disclosures

An investment in the fund is subject to risk and there can be no assurance that the fund will achieve its investment objective. The risks associated with an investment in the fund can increase during times of significant market volatility. The principal risks of investing in the fund include: equity risk, mid-cap company risk, option risk, tax risk, concentration risk and foreign security and emerging market risk. More detailed information regarding these risks can be found in the fund’s prospectus.

The writer of a covered call option forgoes, during the option’s life, the opportunity to profit from increases in the market value of the security covering the call option above the sum of the premium and the strike price of the call, but has retained the risk of loss should the price of the underlying security decline.

As a writer of a covered or cash-backed put option, the strategy bears the risk of loss if the underlying security declines below the strike price of the option minus the premium.

For more information on options and related risks, contact your financial advisor and review the Options Clearing Corporation “Characteristics and Risks of Standardized Options” available at www.theocc.com.

Price-to-Earnings Ratio: measures how expensive a stock is. It is calculated by the weighted average of a stock’s current price divided by the company’s earnings per share of stock in a portfolio.

Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only, and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance.

The S&P 500® is an unmanaged index of large companies and is widely regarded as a standard for measuring large-cap and mid-cap U.S. stock-market performance. Results assume the reinvestment of all capital gain and dividend distributions.

Non-deposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of, or guaranteed by, any financial institution. Investment returns and principal value will fluctuate.

This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.