Mid cap stocks represent a significant portion of the U.S. equity market—about 20%—but they only account for 9% of investment exposure (as of 12/31/2024)1. With mid caps being under-allocated to and overlooked, it’s not surprising that so many investors are still unaware of the benefits of mid cap investing.

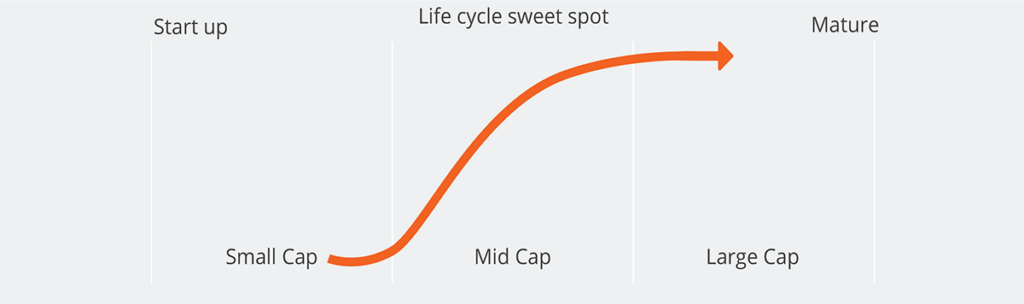

Mid Cap Stocks: An Investment Opportunity in the “Sweet Spot”

Mid cap stocks offer a unique investment opportunity for those seeking a balance between growth and stability. Mid caps sit in a sweet spot between large, well-established companies and smaller, higher-risk enterprises. Despite being overlooked, mid cap companies are typically more stable than small caps while still offering considerable growth potential compared to their large cap counterparts. This blend of dependability and growth potential makes mid caps an appealing choice for investors looking to diversify their portfolios.

What Defines a Mid Cap Company?

Mid cap companies are defined by a market capitalization typically between $1 billion and $60 billion. Because of the makeup of broad market, cap-weighted indices, there tends to be some overlap between large and mid, and mid and small. For instance, the Russell 1000 Index is designed to measure the top 1000 U.S. stocks; the bottom 800 stocks within this index make up the Russell Midcap Index. This does not mean the Russell Midcap Index has an 80% overlap with the Russell 1000. Due to weighting by market capitalization, the Russell Midcap Index only represents around 27% of the Russell 1000.

Mid Cap Portfolio Manager, Andy Romanowich, explains what makes mid cap stocks a unique and compelling investment opportunity.

Mid Caps vs. Large and Small Caps

Because of their size, established business models, and access to capital, mid cap companies offer unique qualities compared to large and small caps. Some of these qualities include:

- Nimbleness: Mid cap business models are typically more established than small cap companies, yet less complex than large caps, which allows them to be nimble and adapt more easily to changing economic conditions.

- Lower risk exposure: Compared to large caps, mid caps generally generate most of their revenue within the U.S. This means that they are less exposed to international risks and currency fluctuations.

- Valuation opportunities: Mid caps are less closely followed by Wall Street analysts compared to large cap companies2. This gives active investors the chance to discover undervalued stocks with strong growth potential.

Mid Caps in an Investment Portfolio

Given the balance of growth and stability, we believe investors should consider a standalone allocation to mid cap stocks. For a detailed analysis of mid caps vs. large and small caps, download the full paper here:

Interested in Learning More?

Disclosures

Non-deposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of, or guaranteed by, any financial institution. Investment returns and principal value will fluctuate.

This website is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Data as of 12/31/2024.

Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only, and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance.

S&P 500®: an unmanaged index of large companies and is widely regarded as a standard for measuring large-cap and mid-cap U.S. stock-market performance. Results assume the reinvestment of all capital gain and dividend distributions. An investment cannot be made directly into an index.

Russell 1000® Index: measures the performance of the 1,000 largest companies in the Russell 3000® Index, which represents approximately 89% of the total market capitalization of the Russell 3000 Index.

Russell 2000® Index: measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 11% of the total market capitalization of the Russell 3000® Index.

Russell Midcap Index: measures the performance of the 800 smallest companies in the Russell 1000® Index.

Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group.

Equity risk is the risk that securities held by the fund will fluctuate in value due to general market or economic conditions, perceptions regarding the industries in which the issuers of securities held by the strategy participate, and the particular circumstances and performance of particular companies whose securities the fund holds. In addition, while broad market measures of common stocks have historically generated higher average returns than fixed income securities, common stocks have also experienced significantly more volatility in those returns.

An investment in the Fund is subject to risk and there can be no assurance the Fund will achieve its investment objective. The risks associated with an investment in the Fund can increase during times of significant market volatility. Investments in midsize companies may entail greater risks than investments in larger, more established companies. Midsize companies tend to have narrower product lines, fewer financial resources, and a more limited trading market for their securities, as compared to larger companies. They may also experience greater price volatility than securities of larger capitalization companies because growth prospects for these companies may be less certain and the market for such securities may be smaller. Some midsize companies may not have established financial histories; may have limited product lines, markets, or financial resources; may depend on a few key personnel for management; and may be susceptible to losses and risks of bankruptcy. More detailed information regarding these risks can be found in the Fund’s prospectus.

Market Capitalization: the total dollar market value of a company’s outstanding shares of stock.