Active Fixed Income Management

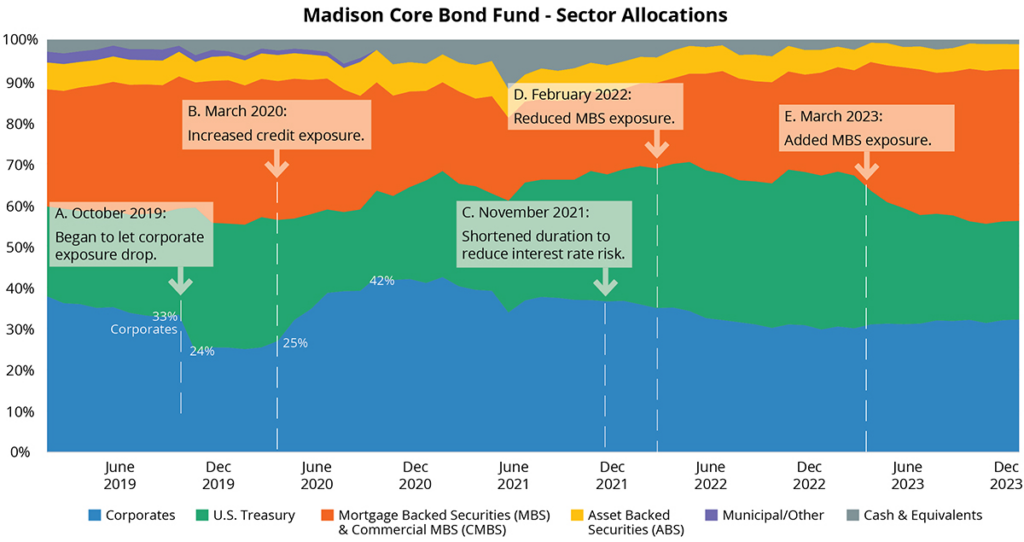

The fixed income landscape is vast and complex. To generate consistent returns and a high level of income while limiting investment risk, a bond manager must navigate the market with agility, taking advantage of mispricings when presented. Below we highlight the strategic decisions our portfolio managers have made over the last five years to demonstrate the flexibility of Madison’s Core Bond Fund.

Corporates

High quality debt issued by U.S. Corporations. The Fund can invest up to 20% in high-yield bonds.

U.S. Treasury

Bonds backed by the U.S. government.

Mortgage Backed Securities (MBS) & Commercial MBS (CMBS)

Securities that are backed by mortgage and commercial mortgage properties.

Asset Backed Securities (ABS)

Securities that are collateralized by an underlying pool of assets, such as credit cards, car leases, and student loans.

Municipal/Other

The Fund can invest in bonds of municipalities and other issuers.

Cash & Equivalents

The Fund can invest in bonds of municipalities and other issuers.

A. October 2019

Began to let corporate exposure drop.

Late in 2019 and into 2020, credit valuations had become rich and uncertainties were mounting. We decided to let our exposure to corporate bonds fall. This provided us flexibility for later should the investment outlook become clearer.

B. March 2020

Increased credit exposure.

As the COVID-19 crisis began to unfold, corporate bond spreads meaningfully repriced. Bonds from very high-quality companies began to trade at significantly discounted levels, compared to just a few months prior.

As a result, our comfort with owning corporate bonds increased significantly. In late March 2020, our credit committee made the decision to move from an underweight to credit to a significant overweight. Over the following months, our strategies were able to purchase significant positions in high quality corporate bonds at very attractive levels. We also focused on longer maturity bonds to further increase the potential impact of tightening credit spreads on the fund.

C. November 2021

Shortened Duration to reduce interest rate risk.

Our view during the latter part of 2021 was that the Federal Reserve would begin a normalization process of monetary policy in 2022. Historically, interest rate increases by the Fed to reduce inflation would end with the Federal Funds rate exceeding the level of inflation, thus creating a positive real Federal Funds rate at the end of the cycle. As 2022 began, the market was still pricing in a Federal Funds rate of only 1.75 to 2.00% by the end of the year, well below the inflation levels at that time.

D. February 2022

Reduced MBS exposure.

Early in 2022, the Federal Reserve indicated a desire to normalize monetary policy by raising interest rates in conjunction with a reduction in the amount of bond purchases (quantitative easing), especially mortgage-backed securities (MBS). Our view was that the economic-sensitive buyers would demand higher yields to purchase MBS versus what non-economic buyers would demand (the Fed). As the year progressed, the market began to realize that, indeed, higher spreads and yields would be needed before buyers would step in.

Our active, relative value approach flagged this mispricing, and as a result, the Fund held far fewer MBS. Those that we did hold demonstrated better risk characteristics. Eventually, MBS spreads widened to levels not seen since the financial crisis in 2008-2009. In late 2022, the Fund began to allocate to the sector, as the relative level of interest rates drove these securities to trade at historically significant discounts. As interest rate volatility diminishes, it is our expectation that the relative attractiveness of MBS will bring buyers back into the market.

E. March 2023

Added MBS exposure.

During the second quarter of 2023, due to liquidity issues within the banking sector, spreads on MBS widened significantly. Investors feared a large amount of selling by banks to raise cash in case of deposit flight. Additionally, quantitative tightening continued, thus increasing MBS supply to the market.

Our view was that the current level of spreads provided value both on an absolute and relative basis. The level of pricing would attract flow from investors, given the relative underweight to the asset class. Additionally, the Fund was underweight low coupon MBS due to Fed and bank ownership leaving spreads too tight. Low coupon MBS was the area of the market that widened the most, allowing the Fund to buy bonds with attractive characteristics and low payups.

Disclosures

Performance data shown represents past performance. Investment returns and principal value will fluctuate, so that fund shares, when redeemed, may be worth more or less than the original cost. Past performance does not guarantee future results and current performance may be lower or higher than the performance data shown. Visit madisonfunds.com or call 800.877.6089 to obtain performance data current to the most recent month-end.

An investment in the Fund is subject to risk and there can be no assurance the Fund will achieve its investment objective. The risks associated with an investment in the Fund can increase during times of significant market volatility. The principal risks of investing in the Fund include interest rate risk, call risk, risk of default, mortgage-backed securities risk, liquidity risk, credit risk and repayment/ extension risk, non-investment grade security risk, and foreign security risk. Mutual funds that invest in bonds are subject to certain risks including interest rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Investing in non-investment grade securities, may provide greater returns but are subject to greater-than-average risk. More detailed information regarding these risks can be found in the Fund’s prospectus.

This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Non-deposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of, or guaranteed by, any financial institution. Investment returns and principal value will fluctuate.

Bond Spread is the difference between yields on differing debt instruments of varying maturities, credit ratings, and risk, calculated by deducting the yield of one instrument from another.